By Stacy Allred, MST, CFP®, Joan DiFuria, MFT, and Stephen Goldbart, PhD

In the first and second parts of this three-part series, we learned about how to build a thriving and connected family of wealth by promoting flourishing and combating languishing. We talked about the importance of solving issues such as purpose, stewardship, effective giving, future thinking, and harmony to be able to do that.

We also discussed how to create a learning roadmap that allows families to be curious, review the activities, and choose the competencies they want to pursue. In this way, we are able to help them flourish across multiple generations.

In this final part, we’ll learn how resilience and agility affect the family for generations to come.

Cultivating Resilience and Agility

The 10×10 Learning Road Map we learned about in the second part of this series cultivates the core qualities we’ve found that are required for success—open-mindedness, resilience, agility, personal agency, and responsibility. These capabilities are critical for what researchers have described as “positive plasticity.” Positive plasticity is the ability to adapt and change in the face of challenges regardless of your age. Positive plasticity leads to successful aging and more satisfaction with life.

By developing positive plasticity, individuals enable themselves to take calculated risks, make smarter decisions, and better manage uncertainty. As a result, they often lead to more prosperous, healthy, and fulfilling lives.

On the flip side, the absence of positive plasticity presents distinct risks. We often hear from parents who are concerned that their financial success may have a damaging effect on their children. For example, they worry that it may lead to children who lack purpose or motivation, and these children may miss out on emotional and social development. Developing a plan that addresses the developmental needs of each family member is the antidote to these fears and can help families actively sidestep potential problems related to significant financial capital.

Implementing a Learning Road Map

Here are four steps an advisor can follow to get a family started on a holistic learning journey:

- Advisors give each family member a 10×10 Learning Road Map chart for their specific stage of life.

- Family members select 1–3 activities (across the 10 internal and external competencies) that they are motivated to pursue.

- Advisors help each family member build an action plan for their selected activities, for the next 90 days (or longer if desired).

- Clients and advisors review the action plan together and determine future steps of the learning journey.

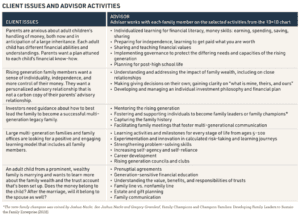

The table below provides some examples of client issues and the activities chosen by family members to address them.

Foundation for Wealth and Life Planning

Building a strong and connected family, enhanced and not undermined by financial abundance, can’t be left to luck or happenstance. It requires intentionality, action, and guidance from a plan designed to develop healthy individuals, align family members with values and goals, and stimulate capabilities and connections that result in longstanding family bonds. Ultimately, all this leads to stronger communities and a stronger world.

Charlie Munger’s ideas about leveraging models are an invitation to all advisors to be curious and take a hard look at their toolkits. Do you have the models you need to support individuals and families so they can focus on their top priorities? Do you have the tools you need to help them build the capacities essential to thriving and meeting the challenges of today’s complex world?

What might you add? What might you need to unlearn?

For more in this series:

- How to Build a Thriving and Connected Family of Wealth Across Generations

- A Learning Roadmap is the Key to a Thriving and Connected Family of Wealth

Become a Member for Your Expertly Curated Advice

Joining the Family Wealth Library means access to the information the legacy builders need to navigate family dynamics and protect our wealth. We can keep what is ours by managing familial challenges and building trust and transparency.